19+ Types of home loans

Compare home loans from 304 comparison rate 310 with Australias biggest financial comparison website to see if you can save. Foundation Home Loans is a specialist mortgage lender offering residential and buy to let mortgages specialising in portfolio landlords and limited companies as well as individuals and those mortgaging a HMO or MUB.

![]()

Types Of Home Loans For Buyers Owners Amerisave Mortgage

M26-4 - VA Servicer Handbook.

. After 8 years the fsagovuk redirects will be switched off on 1 Oct 2021 as part of decommissioning. If you entered into a home loan before 23 October 2018 and havent been advised that your loan is moving to one of the above interest rate types see applicable rates here. You now may need a higher credit score larger down payment and lower debt-to-income ratio to qualify for a home loan.

There are a number of different types of home loans or mortgages available in Australia and the type best-suited to you will depend largely on your personal circumstances. Fluctuations to interest rates occur as a result of changes made to the official cash rate which is set by the Reserve Bank of Australia RBA. Often called a second mortgage home equity loans let borrowers obtain a lump-sum payment that can be used for major home renovations consolidating debts or paying for college tuition.

The COVID-19 pandemic has caused some mortgage lenders to implement stricter loan requirements. They are looked at favourably by the banks because they tend to look after their property well and are more likely to pay their loan on time. Loans grants and vouchers.

Refinance your existing home equity loan at a lower rate. Same-day funding available conditions apply We guarantee your best-funded loan. Types of Reverse Mortgages.

Febreze the ads implied was a pleasant treat not a reminder that your home stinks. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. About Home Loans.

Learn more about our wide array of home equity options. A range of other supports for businesses affected by COVID-19 are available. The loans and credit come in many forms ranging from.

This type of loan offers the option of paying it back in equal installments. All home loans are subject to lending criteria terms and fees. Theres a lot of flexibility around the down payment eligibility guidelines.

First home buyers and other people buying an owner-occupied house make up the majority of people applying for 100 home loans in Australia with the help of a guarantor. When your variable home loans interest rate rises or falls your mortgage repayments will too. Read more information about reverse mortgages.

The three types of reverse mortgages include. Use our financial calculators to determine your best deal. Home Loans Materials.

Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. The reverse mortgage does not have to be paid back as long as you live in your home. VA Home Loans VA Appraisal Fee Schedules and Timeliness Requirements The allowable fees for the appraisal type and the number of days allowed for completion can be found in the table below under the supporting Regional Loan Center.

M26-3 - Loan Management and Service Policies Procedures and Methods Loan Guaranty Operations for Regional Offices. This Circular announces new procedures for loan approval where the borrower has a VA-appointed fiduciary. Conventional loans are the least restrictive of all loan types.

Conventional loan with PMI. And so Febreze a product originally conceived as a revolutionary way to destroy odors became an air. As with the previously mentioned COVID-VAPCP VA will establish a second lien for any portion of the loan VA purchased to provide payment relief to the borrower.

Refinance rates valid as of 31 Aug 2022 0919 am. Read the comparison rate warning. Read reviews and recommendations from our experts on the best low interest credit cards available from our.

Consumer loans and credit are a form of financing that make it possible to purchase high-priced items you cant pay cash for today. The GoDaddy Blog offers in-depth articles about websites domains hosting online marketing WordPress and more. Mortgage brokers work with multiple lenders and can help evaluate the types of home loans available to you.

Typically home equity loans are for 80 to 90 of the propertys appraised value. M26-2 - Construction and Valuation Policies Procedures and Methods. The COVID-19 Credit Guarantee Scheme provided loans from 10000 and 1 million for terms up to five and a half years.

Banks credit unions and online lenders are the source for most consumer loans and credit though family and friends can be lenders too. Home loans for more than 25000 in Presidential and Agency declarations must be secured with collateral to the extent possible. The size of the loan was linked to business turnover 25 of 2019 turnover or wage costs double annual wage bill in.

Types of Disaster Loans. You will not have to sell the home or take on additional monthly bills. COVID-19 Credit Guarantee Scheme.

A variable rate home loan is a home loan with an interest rate that is subject to change throughout the life of the loan. Frequently Asked Questions FAQ Number of Views. Number of Views 1908K.

M26-9 - Quality Control Procedures Loan Guaranty Operations for. Buying a house to live in. Showing the different property types and ownership types of the properties in an example portfolio demonstrating the.

Number of Views 6682K. Number of Views 6065K. Lowest rate is for excellent credit only.

Rates 573 - 1999 APR wautopay Loans from 5000 - 100000. 5 to 1999 down. As part of our mission to serve you we provide a home loan guaranty benefit and other housing-related programs to help you buy build repair retain or adapt a home for your own personal occupancy.

You only repay the loan when you sell your home or permanently leave it. Just be sure to. M26-1 - Guaranteed Loan Processing Manual.

We also offer home equity loans that allow you to use up to 100 of your homes value. Cash Back Offer terms and conditions apply. An establishment fee of 150 may apply.

Suivez en direct toute lactualité de la pandémie de Covid-19-coronavirus en France et dans le monde ses conséquences sur la vie quotidienne et bien plus encore. Circular 26-22-9 - May 19 2022 New Procedures for Loans where the Borrower Has a VA-appointed Fiduciary and for Loans Commonly Called Joint Loans PURPOSE. Rates are applicable to both primary and secondary residences.

Types of Consumer Credit Loans. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for. Economic Injury Disaster Loans.

VA helps Servicemembers Veterans and eligible surviving spouses become homeowners. Business Physical Disaster Loans. The COVID-19 Refund Modification is designed to give Veterans and their families an opportunity to retain home ownership with a reduced monthly mortgage payment.

Owning a credit card with a low interest rate can help you save money on APR charges.

2

Types Of Home Loans For Buyers Owners Amerisave Mortgage

Uk Tuition Fees For Eu Eea Students In 2022 Changes After Brexit Mastersportal Com

Student Loan Forecasts For England Methodology Explore Education Statistics Gov Uk

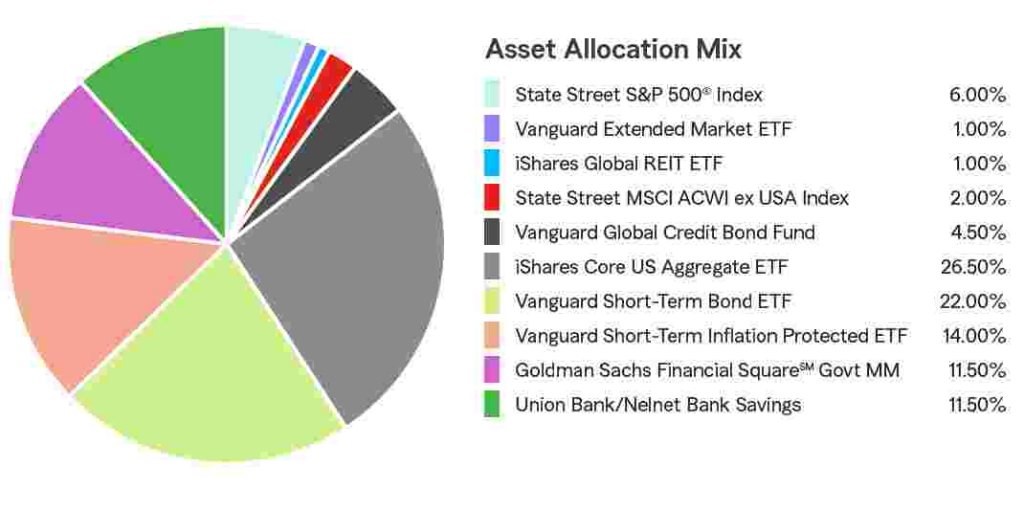

State Farm 529 Savings Plan Age Based 19 Plus Portfolio State Farm

Cost Search Results Student Financial Services Washington State University

Latvia

2

2

Ready To Buy A Home Download Realtor Com S Free First Time Homebuying 101 Ebook Today Homemade

2

Estonia

Types Of Home Loans For Buyers Owners Amerisave Mortgage

Digital Stimulus Packages Lessons Learned And What S Next

2

Finland

How To Choose 529 Plans For Your Child S Education Moneygeek Com